Retirement means different things to different people

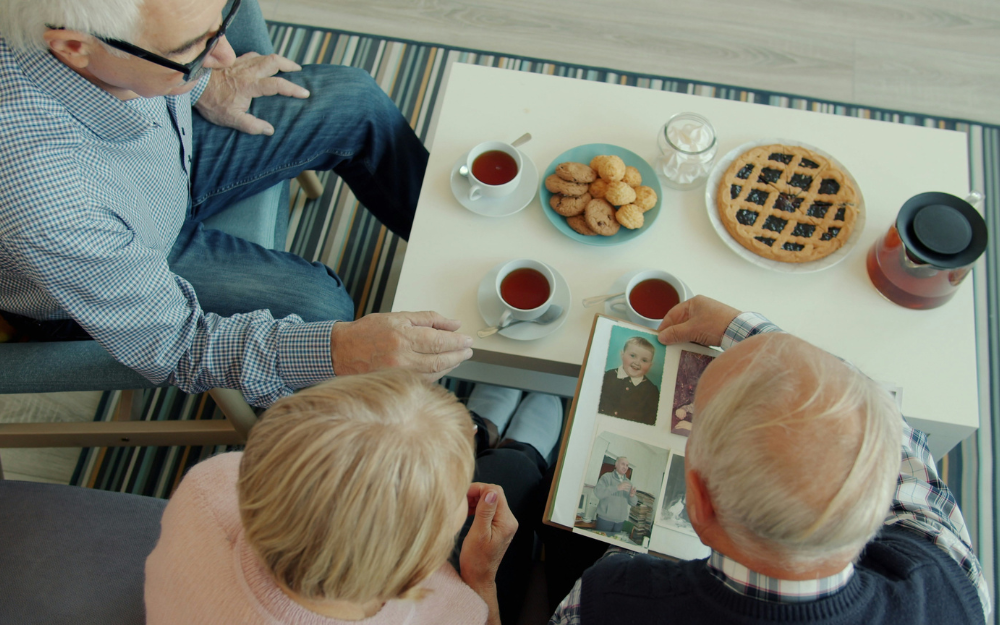

For some, traveling around in Australia in a caravan is a life-long dream but for others flying at the pointy end of the plane and staying in 5-star hotels around the world is more how they see life after work. Or maybe spending more time with the grandkids or volunteering in your local community rate high on your list of retirement goals.

We all have different ideas of what the second half of our lives looks like and that’s why everyone’s retirement plan will be different.

Why is retirement planning important?

We are living longer and for most of us compulsory superannuation payments or the Age Pension alone won’t be enough to help us achieve the retirement lifestyle we’re dreaming about.

Putting a long-term financial plan in place will provide you with the comfort of knowing that you can do all those things that you dreamed of and that your financial future is under control. As we all approach our golden years, it becomes even more important that you live your life as you’d like to and remain in control of your financial affairs.

How much will you need?

This is the magic question and how much money you need in your retirement nest egg will depend entirely on how you want to live in retirement.

According to the Association of Superannuation Funds of Australia’s Retirement Standard June 2023, to have a ‘comfortable’ retirement, single people will need $50,207.02 in retirement income, and couples will need $70,806.43.

The Retirement Standard is updated four times a year to take into consideration the rising price of items like food and utility bills, as well as changing lifestyle expectations and spending habits. The Retirement Standard includes the cost of things such as health, communication, clothing, travel and household goods. To see the latest Retirement Standard click here.

Of course, this is a guide only. Some people may need more or less, depending on their goals, values and how they choose to live their life!

How can we help you with retirement planning advice?

Alphington Private Wealth Financial Advisers can help you work out how much money you have now, how much you might have in the future and where it is coming from.

We will help you:

- Identify your retirement goals

- Review your income and cashflow requirements

- Identify what assets (house, savings, investments) you have and how much they are worth

- Assess how much super you have and when you can access it

- Find ways to grow your retirement income

- Put plans in place to make your money last in retirement

- Determine when you can apply for the age pension and whether you are likely to be eligible

- Review your estate planning.

To make an appointment, call us on 03 9038 9449 (Melbourne) during business hours. Alternatively, complete the contact form and a member of our team will reach out to you to make an appointment for you. We can meet face to face in our offices, and in capital cities. Video meetings are also available.