From 1 July 2018, individuals with a total superannuation balance of less than $500,000 will be able to “carry forward” any unused portion of their concessional contribution cap for up to 5 years. Any carried forward amounts that are not used within 5 years will expire and be forfeited. The unused amounts will start to accrue from 1 July 2018.

The earliest you are able to make additional concessional contributions by applying the unused concessional contribution cap amounts is 1 July 2019.

The carry forward concessional contributions may assist you to ‘catch-up’ on contributions if you are expecting a lump sum payment, or have irregular employment income.

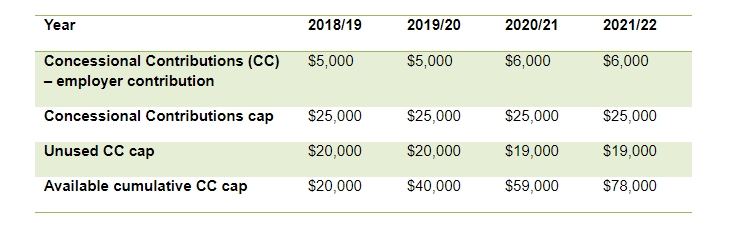

Carry-forward concessional contributions in action

William is an employee and only receives super guarantee contributions from his employer. Over the four years, William has a significant unused portion. William could utilise carry-forward concessional contributions to use any of this unused cap by making addition contributions into his super.

In financial year 2021/2022, William could make a $78,000 concessional contribution to super on top of the $6,000 he would receive from his employer.