If you make a personal contribution to super the Australian Government may also contribute up to $500 into your super. This is known as a Government co-contribution.

For the 2018/2019 financial year, if you meet all the requirements and make a personal contribution (using your after-tax money) into super, the Government will contribute up to an additional $500. This means that for every $1.00 of personal contribution, the Government may contribute an additional 50¢ (cents) (up to $500), which would effectively be a 50% return on your money.

What are the requirements?

To qualify for the Government co-contribution, you must be gainfully employed. You also need to earn at least 10% or more of your total income from carrying on a business, eligible employment or a combination of the two. This means you can either be employed or self-employed. You also need to be less than 71 years old at the end of the financial year you make the personal super contribution.

Other conditions are:

- You make a non-concessional contribution to a complying super fund in the relevant year and don’t claim a tax deduction on this amount.

- You lodge a tax return for the year.

- You don’t hold a temporary resident visa at any time during the financial year.

- Your total income is below the income thresholds. Total income is assessable income plus reportable fringe benefits and reportable employer super contributions (which excludes your compulsory super guarantee contributions).

Your adviser can help you work out if you qualify.

I’m self-employed; can I still receive a co-contribution?

Self-employed workers are able to receive the co-contribution, however, the income test is more complicated than for an employee (for example, total income for a self-employed person isn’t reduced by your allowable business deductions when calculating the above stated 10% rule). You can discuss this with your financial adviser and they will determine if you are eligible.

Can I reduce my income through salary sacrificing?

No, any salary sacrificed income is added back when determining your eligibility for the Government co-contribution.

What are the income requirements?

You will qualify for the full co-contribution if your total income is below the lower income threshold.

If your total income is above the upper income threshold, you don’t qualify for the co-contribution and aren’t entitled to receive any co-contribution from the Government.

If your income is between the upper and lower income thresholds, you will qualify for a part co-contribution. We’ve included some examples below.

You will receive a 3.333¢ (cents) reduction in the amount of co-contribution for every $1 that your total income exceeds the lower threshold.

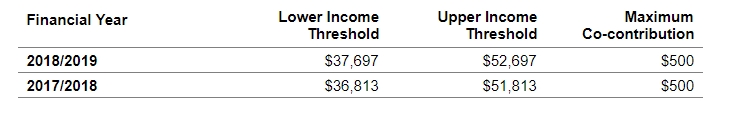

The lower income threshold and upper income threshold is indexed each year. The amounts shown in the table above have been indexed.

What is the proposed maximum co-contribution I can receive?

For the 2018/2019 financial year, the maximum co-contribution is 0.5 times the amount of your contribution, up to $500. For example, if you contribute $12,000 and are under the lower income threshold, then the maximum co-contribution you can receive is $500.

How do I receive the co-contribution?

The amount of co-contribution you are entitled to is automatically calculated by the Australian Tax Office (ATO) after you have lodged your income tax return. The ATO will then pay the amount of the co-contribution into the same super fund you made the original contribution into. If this super fund has been closed, the ATO will notify you and ask you for details of a super fund into which they can pay the contribution.

Examples

The following examples are based on the Government co-contribution rates for the 2018/2019 year.

Example 1 – Full Co-contribution

Rebecca is working part-time and earns a salary of $29,000 per annum. She has no other income. Rebecca makes a personal contribution into her super using $1,000 from her personal bank account. As Rebecca’s total income is below the lower threshold, she will qualify for the full co-contribution of $500.

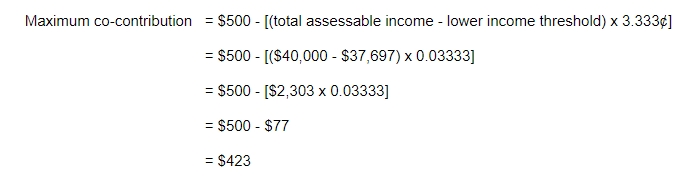

Example 2 – Part Co-contribution with $1,000 after-tax contribution

Daniel is aged 25 and is earning a salary of $40,000. He contributes $1,000 into super as a personal contribution using money from his bank account.

As Daniel’s total income of $40,000 is over the lower income threshold, but below the upper income threshold, he will receive a reduced co-contribution calculated as follows:

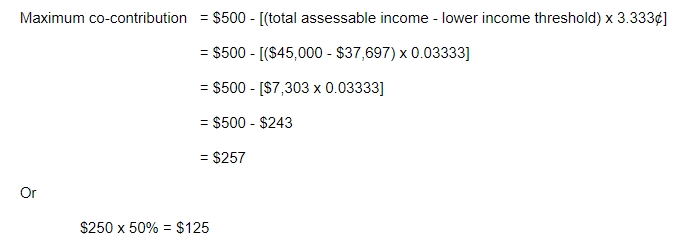

Example 3 – Part Co-contribution with $250 after-tax contribution

Craig is earning a salary of $45,000 and makes a personal contribution into super using $250 from his bank account. As Craig’s total income of $45,000 is between the lower and upper income thresholds, he will receive a reduced co-contribution calculated as follows:

Craig will receive the lower of:

- $500 – [(total assessable income – lower income threshold) x 0.03333], or

- The amount of his personal contribution multiplied by 50%

As Craig contributed $250, the maximum co-contribution he can receive is $125.