Salary sacrifice into super is one of the simplest, yet most tax-effective ways you can build your super balance to assist you in achieving your lifestyle goals and objectives in retirement. Salary sacrifice is an arrangement between you and your employer where you agree to forego part of your pre-tax salary in return for your employer using those funds to increase your super contributions. It simply means, instead of receiving part of your salary in cash, you decide to invest it into your super fund.

What are the benefits of salary sacrifice?

Tax savings

When correctly structured, salary sacrifice into super can result in a reduction in your taxable income, and therefore reduce the amount of personal income tax you pay in the year the salary sacrifice occurs. This then allows you to contribute more funds into super, building up your retirement savings.

This tax saving occurs because tax on your salary can be anything from 0% to 45% (plus Medicare levy), whereas you will only pay 15% contributions tax on super contributions if you stay within the concessional cap limits.

Individuals with income above $250,000, using the adjusted definition set by the Australian Taxation Office, will be required to pay 30% contributions tax on concessional contributions, as opposed to the standard 15%. However, you may still save tax by contributing to your super. In addition, you can accumulate funds in super where earnings are taxed at a maximum rate of 15% as opposed to your marginal rate of tax, which could be as high as 45% (plus Medicare levy).

Flexibility

A final benefit of salary sacrifice is its flexibility, as you are not locked into salary sacrificing a set amount for the year. As you get paid on a weekly, fortnightly or monthly basis, you should be able to alter the amount of your salary sacrifice relatively quickly. This will depend upon your employer, but most employers are able to change your level of salary sacrifice in your next pay if you meet their cut-off times.

This means that if you need to decrease your level of salary sacrifice for some reason, you can. It also means that if you find yourself with spare cash, you can also increase your level of salary sacrifice relatively quickly as well.

What are the disadvantages of salary sacrifice?

Reduction in take home pay

The most important thing to realise is that by salary sacrificing into super, you are reducing your take home pay. If you find you are struggling with the reduced income amount, discuss this with your financial adviser and together you can determine the correct level of salary sacrifice to suit your current circumstances.

Access to the funds

Super receives concessional tax treatment because it is to be used to help fund your retirement. As a result of this, there are certain conditions as to when you can access your super. You need to be aware that you generally cannot access your super as an income stream until you reach your preservation age. You cannot access your super as a lump sum until you either retire or turn age 65. As such, if you require access to the funds before this time, salary sacrifice into super may not be the best strategy for you. For more information, please refer to the ’Withdrawing from Super” fact sheet under the Superannuation Financial Education Series.

Future income

Another disadvantage is that you can only salary sacrifice future income, or future salary and bonus entitlements not yet earned or received by you. This means that if you have received a bonus, you cannot salary sacrifice it into super unless you informed your employer prior to receiving the bonus that was what you wanted to do.

What about my current Super Guarantee Contributions (SGC)?

Your employer is currently paying a minimum of 9.5% of your salary into super under the SGC rules.

If you commence salary sacrificing your employer can legally reduce the amount of SGC that they are required to pay, by basing it on your reduced salary. Additionally your employer may count your salary sacrifice contributions towards the 9.5% SGC, as salary sacrificing is a form of employer contributions.

However many employers will continue to pay SGC on the original value of your salary and in addition to your salary sacrificing. It is important that you check this with your employer before you commence salary sacrificing.

Is there a limit on the amount I can salary sacrifice into super?

Yes, the amount sacrificed, including any compulsory employer super such as Award or SGC, cannot exceed the concessional contribution caps of $25,000 from 1 July 2017. If you exceed this amount, the excess will be taxed at your marginal tax rate (plus an interest charge) which defeats the point of a salary sacrifice strategy.

For more information, please refer to the ‘Super Contribution’ fact sheet under Superannuation Financial Education Series.

Can my employer limit the amount sacrificed?

Some employers do limit the amount of salary an employee can salary sacrifice, while others will allow you to salary sacrifice all of your salary. You should check this with your employer before beginning to salary sacrifice.

Please be mindful that it is your responsibility to ensure that the contribution caps are not exceeded, not your employers. You should speak to your financial adviser around the appropriate level to salary sacrifice to ensure you contribute within the allowable limits.

Will salary sacrifice impact my eligibility for other benefits or tax rebates?

Yes, your salary sacrificed contributions to super will be counted as income when determining your eligibility for the following:

- Government co-contribution

- Ability to claim a tax deduction for personal super contributions

- Medicare levy surcharge

- Private health insurance rebate

- Spouse contribution tax offset (for the receiving spouse)

- Senior Australian tax offset

- Pensioner tax offset

- Mature age worker tax offset

- Dependant spouse tax offset

- Baby bonus

- Family Tax Benefit Part A and B

- Income support payments under Age Pension age

- Commonwealth Seniors Health Card

- Income tested fee for Aged Care

- Child support

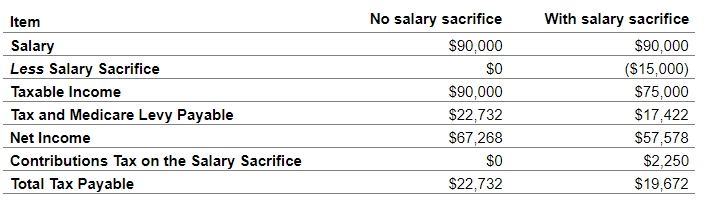

While this may reduce the benefits of salary sacrifice, there are still tax savings available as illustrated below.

Is fringe benefits tax payable?

No, super is an exempt benefit and no fringe benefits tax is payable.

Example – salary sacrifice

Adam is aged 45 and is earning a salary of $90,000. His employer currently contributes 9.5% SGC or $8,550 into super, and has confirmed this will be paid even if he reduces his salary by using salary sacrifice. Adam has just finished paying off his home loan and is now able to save $1,250 of after-tax money per month, or $15,000 per annum. Let’s compare Adam salary sacrificing that money into super, as opposed to spending it. Adam is mindful that he is within his total concessional contributions limit of $25,000, which includes his SGC and salary sacrifice contributions.

As illustrated, Adam can salary sacrifice an additional $15,000 into super and he will save $5,310 in personal income tax ($22,732 minus $17,422). When the additional contributions tax is taken into account his tax saving has reduced to $3,060 ($22,732 minus $19,672).

However, Adam’s take home pay has only reduced by $9,690 ($67,268 minus $57,578) while his super balance has increased by $12,750 after taking into account the contributions tax payable ($15,000 minus $2,250).

This achieves his objective of growing his retirement savings.

As you can see, if Adam continued to salary sacrifice into super up to retirement he will greatly increase his super balance, providing him with the potential for a much greater quality of life in retirement.

Instead of salary sacrificing how else can I get the same benefit?

As discussed above, some employers limit the amount you can salary sacrifice into super or don’t allow you to get the full benefit. Instead of salary sacrificing into super, you can now contribute money from your bank account and claim a tax deduction.

The advantages of doing this are that you are able to contribute as much as you are able to afford, up to your cap of $25,000. You could consider keeping the money in your offset account, to reduce the interest on your mortgage and then in June withdraw the money and contribute it into super.

You need to lodge a form (A notice of intent to claim a tax deduction) to ensure you get the tax deduction, but your adviser can help you.

This also means that you can contribute payments that you may not be able to salary sacrifice, such as bonuses and leave payments.

We recommend you talk to your adviser.